The Fulwider Agency (FAI) and Wuestenberg Agency (WAI) are very committed to the well-being and safety of our customers, employees and the communities we serve. As the Coronavirus/COVID-19 Pandemic continues to progress, we want to inform you of the efforts we have made in order to keep as many people safe from either obtaining or spreading the Coronavirus as possible. FAI & WAI has been continually monitoring and relying on recommendations of the CDC & Public Health Officials which have been rapidly changing hour by hour.

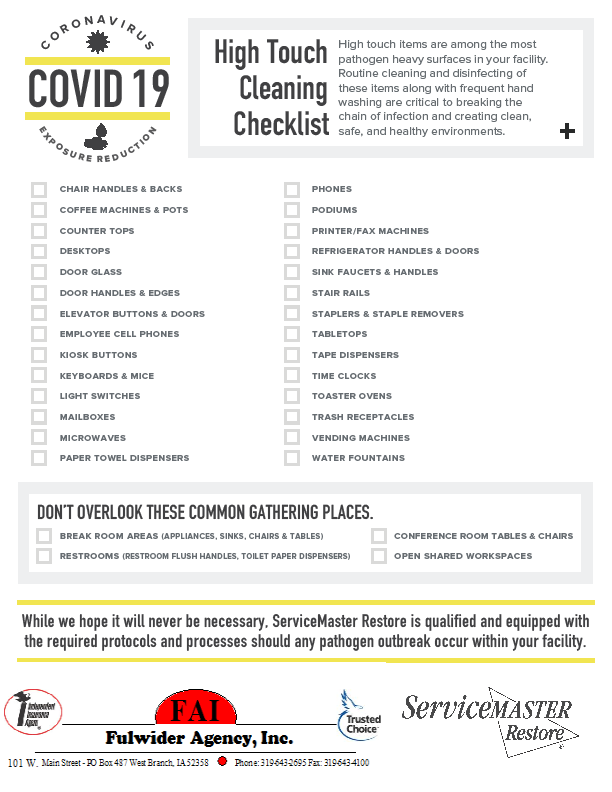

As a result of the potential impacts of this virus, we are trying to limit in-person exposure. At this time, our offices remain open, though we ask that you only visit with an emergency need. Also, please call ahead to make an appointment. We are working to implement social distancing, and are thoroughly cleaning the office surfaces to prevent the spread of germs. We can still service all of your needs via phone, email or fax. We strive to still provide excellent service to our clients, even with the trying times, while still trying to limit everyone’s exposure to the Coronavirus/COVID-19. We hope you all understand and hope that you all take precautions as well to limit your exposure to the Coronavirus.

Please know that if you need to obtain a quote, make a change, make a payment, file a claim, ask a question or need to obtain new insurance coverage, we can still provide ALL of these services via phone or email. Here is how to contact us during this unstable & fluid time.

WAI Contact Information:

Call the Office first: 319-627-2184

Visit our Website: fulwideragency.wordpress.com

Reach us via Cell or email:

Bob Fulwider: Cell: (319) 430-8518, E-mail: bfulwider@fai-wai.com

Jan Fulwider: Cell: (319) 430-8591, E-mail: jfulwider@fai-wai.com

Gloria Zamora: Cell: (563) 299-4132, E-mail: gzamora@fai-wai.com

FAI Contact Information:

Call the Office first: 319-643-2695

Visit our Website: fulwideragency.wordpress.com

Reach us via Cell or email:

Bob Fulwider: Cell: (319) 430-8518, E-mail: bfulwider@fai-wai.com

Steven Grace: Cell: (319) 430-1133; E-mail: sgrace@fai-wai.com

Jan Fulwider: Cell: (319) 430-8591, E-mail: jfulwider@fai-wai.com

Konnor Myrvik: Cell: (319) 330-2213, E-mail: kmyrvik@fai-wai.com

Karen Thurness: Cell: (319) 331-8076, E-mail: kthurness@fai-wai.com

If you typically drop off payment in our office, please call us to make other arrangements prior to arrival. You can also visit the “About/Contact” tab which shows how to contact each of our agents via phone or email. Please check back on our website often for any further updates as the Coronavirus/COVID-19 Pandemic evolves and changes.

Thank you so much for your understanding. We look forward to continuing to serve your insurance needs and answering any insurance questions you may have.

Sincerely,

Bob & Jan Fulwider

Fulwider Agency, Inc & Wuestenberg Agency, Inc

West Branch & West Liberty, IA

WL Office: 319-627-2184

WL Fax: 319-627-2186

WB Office: 319-643-2695

WB Fax: 319-643-4100